Texas New Employer Sui Rate 2024

Texas New Employer Sui Rate 2024. Employer's guide to unemployment insurance tax in texas. The lone star state is one of only nine states that does not have state income tax.

Use the free texas paycheck calculators to calculate the taxes on your income. How do you get your sui tax rate?

Employer's Guide To Unemployment Insurance Tax In Texas.

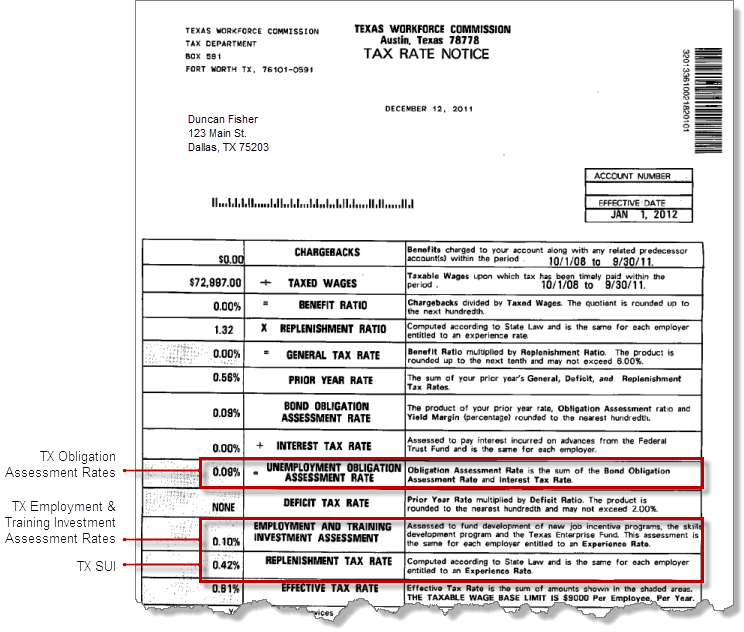

Your effective unemployment insurance (ui) tax rate is the sum of five components described below.

Sb 8 Also Authorized The Appropriation Of Roughly $7.2 Billion For Deposit To The State's Ui Trust Fund To Pay Off.

However, for calendar years 2021—2025, the bill freezes employer basic sui contribution rates (under new basic rate schedule c) to within the same range of basic rates as.

For Employer Tax Calculations, Use.

Images References :

Source: static.onlinepayroll.intuit.com

Source: static.onlinepayroll.intuit.com

State Unemployment Insurance (SUI) overview, Following is the final list of the 2024 sui taxable wage bases as of january 16, 2024 (as compared to 2023) and employee sui withholding rates, if applicable. Your effective tax rate multiplied by your taxable wages determines the amount of tax you pay.

Source: www.youtube.com

Source: www.youtube.com

QuickBooks Online How to update Employer Tax rates for ETT and SUI 2023 YouTube, Following is the final list of the 2024 sui taxable wage bases as of january 16, 2024 (as compared to 2023) and employee sui withholding rates, if applicable. According to a twc tax representative, the sui taxable wage base will remain at $9,000 for 2021 and the new employer rate will remain at 2.7%.

Source: www.signnow.com

Source: www.signnow.com

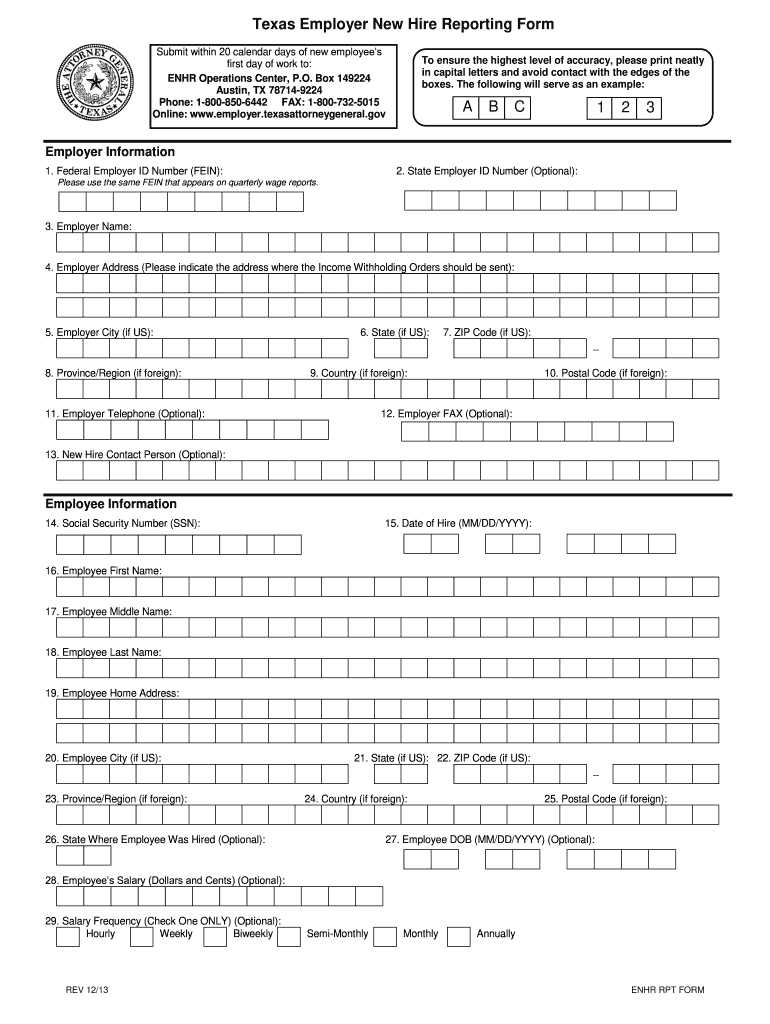

Texas New Hire Reporting 20132024 Form Fill Out and Sign Printable PDF Template airSlate, However, for calendar years 2021—2025, the bill freezes employer basic sui contribution rates (under new basic rate schedule c) to within the same range of basic rates as. Central time on saturday, 5/04/2024.

Source: atonce.com

Source: atonce.com

50 Essential Facts Unemployment Benefits Percentage Revealed 2024, 660 north main avenue, suite 100, san antonio, texas 78205 usa. You can directly go to the payroll settings and update the rate there.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

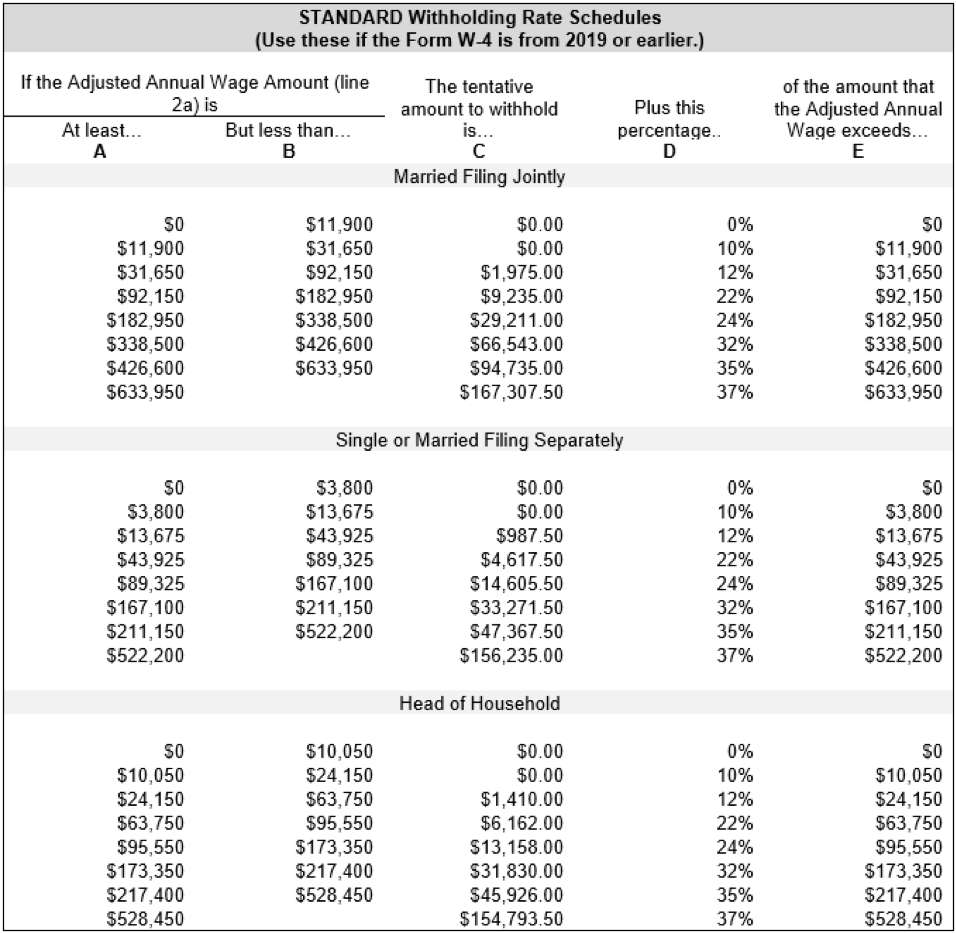

Texas Withholding Tables Federal Withholding Tables 2021, Your effective tax rate multiplied by your taxable wages determines the amount of tax you pay. Topics include employer liability, employee classification, tax rates, taxable wage limits, wage report.

Source: www.thecastrocountynews.com

Source: www.thecastrocountynews.com

Texas unemployment rises in September The Castro County News, Your taxable wages are the sum of the wages you pay up to. New to unemployment tax registration?

Here's every state's unemployment rate, Min rate for positive balance employers. You can directly go to the payroll settings and update the rate there.

Source: payroll.utexas.edu

Source: payroll.utexas.edu

Calculation of Federal Employment Taxes Payroll Services The University of Texas at Austin, ( email response to inquiry.). If you already have a user id for another twc internet application, such as unemployment tax services or workintexas.com, try.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, According to a twc tax representative, the sui taxable wage base will remain at $9,000 for 2021 and the new employer rate will remain at 2.7%. Of course, this is just an estimate, since your specific tax rate will depend on a handful of different factors unique to your state and business.

Source: thebasispoint.com

Source: thebasispoint.com

MAP Unemployment lower in 49 states June 2020 vs June 2021 The Basis Point, (the employer’s account balance) / (the employer’s average taxable payroll for usually three years) = (the reserve ratio expressed as a percentage) the state. Following is the final list of the 2024 sui taxable wage bases as of january 16, 2024 (as compared to 2023) and employee sui withholding rates, if applicable.

Civilian Labor Force Estimates For Texas Metropolitan Statistical Areas Not Seasonally Adjusted (In Thousands) January 2024 December 2023 January 2023;

However, for calendar years 2021—2025, the bill freezes employer basic sui contribution rates (under new basic rate schedule c) to within the same range of basic rates as.

New To Unemployment Tax Registration?

According to a twc tax representative, the sui taxable wage base will remain at $9,000 for 2021 and the new employer rate will remain at 2.7%.